Andrew Amoils is Head of Research at wealth intelligence firm New World Wealth.

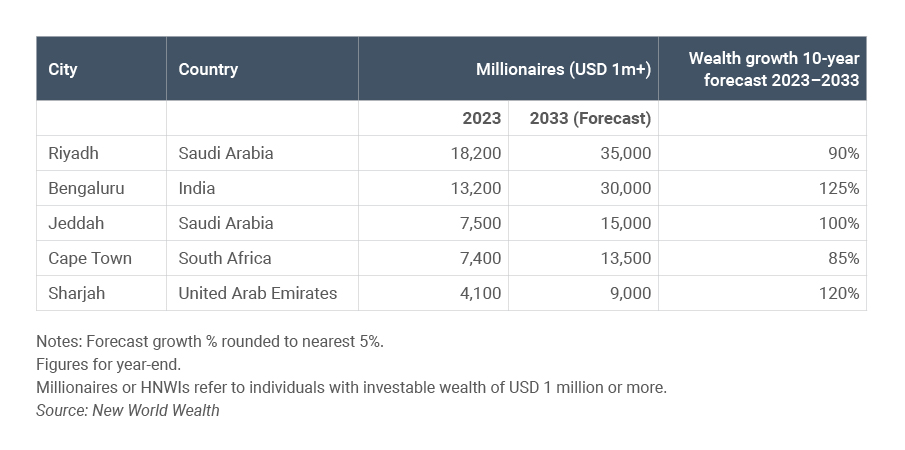

The five BRICS cities below did not make the BRICS Top 10 Wealthiest Cities list for 2024 but are all expected to experience very strong (80%+) wealth growth over the coming decade (to 2033).

Table 1. BRICS Cities of the Future

Riyadh

Riyadh accounts for the bulk of Saudi Arabia’s non-oil gross domestic product. It is the base city for Saudi Arabia’s largest banking groups, including Saudi National Bank. It is also home to the Saudi Stock Market (Tadawul) which is the 12th largest stock market in the world by market cap, as well as the sovereign wealth fund of Saudi Arabia — commonly known as the Public Investment Fund. Popular parts of Riyadh for affluent residents include the Diplomatic Quarter (Al Safarat) and historic areas such as Diriyah on the outskirts of the city. There are approximately 18,200 high-net-worth individuals (HNWIs)1 currently living in the city and this number is projected to reach over 35,000 by 2033.

Bengaluru

Bengaluru is known as the “Garden City” and the “Silicon Valley of India”. It has a booming tech sector and is the base city for global tech giants Infosys and Wipro. The city is currently home to approximately 13,200 HNWIs and this number is projected to reach over 30,000 by 2033, making it the fastest growing city in the BRICS bloc over the coming decade in percentage growth terms.

Jeddah

Jeddah is a historical coastal city on the Red Sea and is home to many of Saudi Arabia’s wealthiest families. It is the country’s main port and is located relatively close to the holy city of Mecca. There are approximately 7,500 HNWIs currently living there, and this number is projected to reach over 15,000 by 2033.

Cape Town

Home to over 7,400 HNWIs, Cape Town contains some of the world’s most opulent residential suburbs including the likes of Bantry Bay, Bishopscourt, Camps Bay, Clifton, Constantia, Fresnaye, Llandudno, and St. James. It is currently benefiting from the ongoing ‘semigration’ of large numbers of HNWIs from other parts of South Africa (especially Johannesburg and Pretoria). It is also an increasingly popular retirement destination for migrating HNWIs from Africa, Europe, Russia, and the UK. Cape Town is projected to reach over 13,500 millionaire residents by 2033.

Sharjah

Despite accounting for far less of the UAE’s wealth than Dubai and Abu Dhabi, Sharjah’s wealth is growing at a slightly faster rate than both these cities in percentage growth terms. There are currently 4,100 HNWIs living in the emirate and this number is projected to reach over 9,000 by 2033.

Although our wealth growth forecasts are very strong for these cities, there are several potential stumbling blocks that could hold them back over the next decade. These key risks are listed below.

USA’s dominance of global tech sector

Despite the recent rise of BRICS-based tech companies such as Alibaba, Huawei, Infosys, Tencent, Wipro, and ZTE, the USA still largely controls the global tech space and the World Wide Web through US-based tech giants Apple, Google, and Microsoft, and via cloud computing platforms such as Amazon Web Services. Chipmakers Intel and Nvidia are also both based in the USA, as is the world’s largest online retailer, Amazon.

Crime and safety

The safety levels in a country and the efficiency of the local police are probably the most critical factors in encouraging long-term wealth growth. Of concern, BRICS nations are often ranked among the most dangerous countries on earth, especially when it comes to key metrics such as murder rates, woman safety, and child safety. BRICS nations also perform poorly on the Global Peace Index.

US dollar standard

The US dollar is the main store of wealth globally and most major forex transactions flow through it. As a result, BRICS countries often hold large US dollar reserves. This creates several problems for BRICS members and there is talk of them forming a BRICS currency, although this seems unrealistic when considering all the difficulties associated with forming the euro and its limited success in replacing the US dollar standard.

Media freedom and neutrality

Media freedom is a major challenge in several BRICS countries with China, Iran, Russia, and Saudi Arabia being the most glaring examples. Media freedom and neutrality are key to wealth creation as they give investors the confidence to invest long term and also hold wrongdoers to account.

Sanctions

US sanctions against new BRICS entrant Iran could prove to be a big problem for the bloc going forward. The ongoing ban on Huawei 5G by several Western countries is also a concern, especially if it spreads to cover other BRICS-based tech companies.

Wealth migration

Except for the UAE, the BRICS nations consistently lose large numbers of HNWIs to migration annually. This holds them back from reaching their full potential as much of their hard-earned wealth growth becomes eroded. See Henley & Partners’ Wealth Migration Report for more details.

1 Millionaires or HNWIs refer to individuals with investable wealth of USD 1 million or more. HNWI figures are rounded to the nearest 100. Current figures for December 2023.