Dr. José Caballero is Senior Economist at the IMD World Competitiveness Center in Lausanne, Switzerland.

In January 2024, the members of BRICS (Brazil, Russia, India, China, and South Africa) welcomed Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE into the organization.1 The expanded BRICS represents about 45% of the world’s population, USD 28.5 trillion of global gross domestic product (GDP) — which is about USD 100 trillion — and around 45% of global oil production.2 In addition, as this report shows, the forecasted wealth growth in these countries is notable. One significant aspect of such wealth creation and its sustainability is competitiveness. We understand competitiveness as the capacity of an economy to promote an environment in which enterprises can generate sustainable value.3 In this essay, therefore, we focus on the competitiveness strengths of six members of the expanded BRICS.4 Competitiveness strengths are those aspects in which an economy performs relatively well over time.5

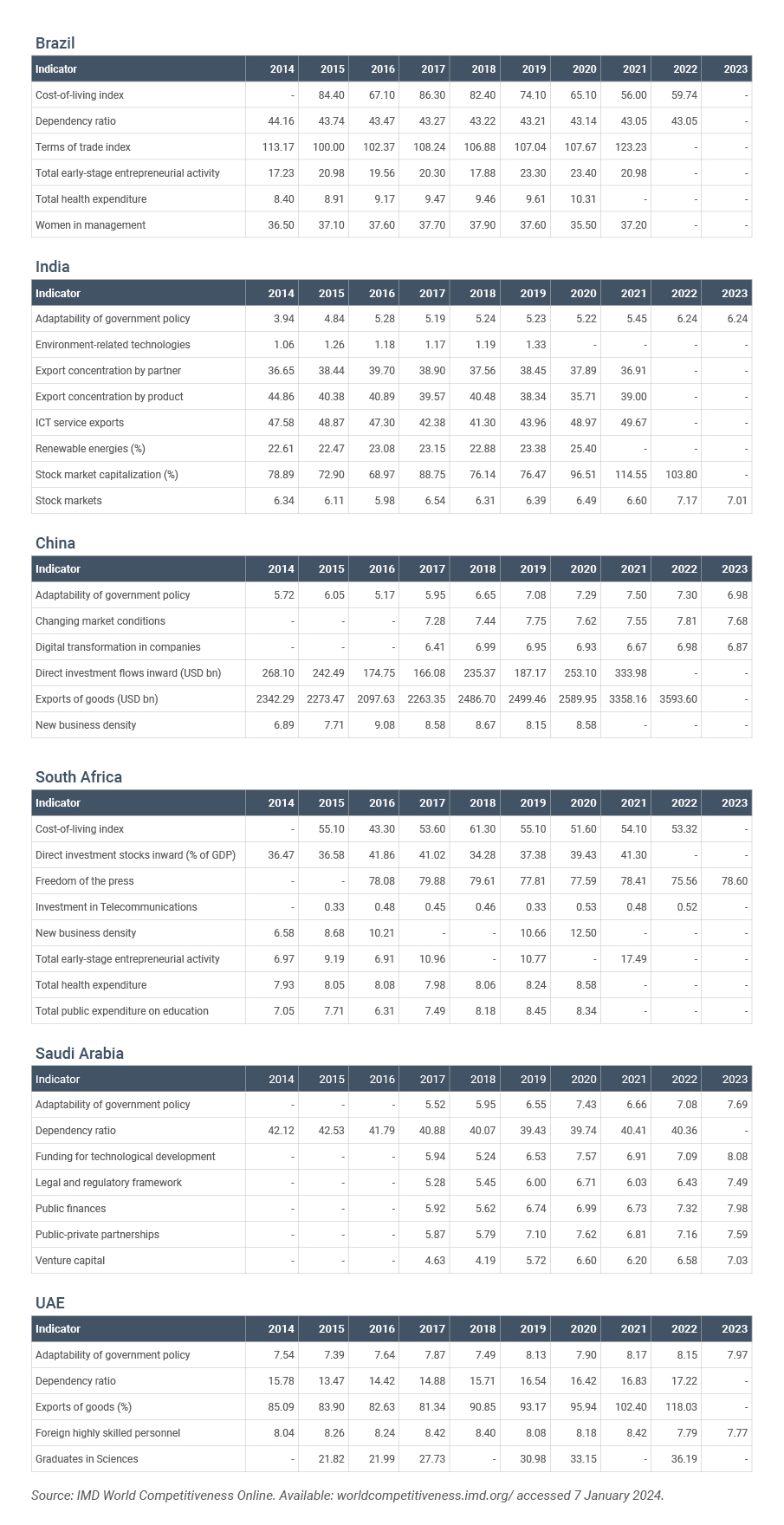

This essay, thus, presents the main competitiveness strengths of the members of the expanded BRICS. It is important to note that not all members are included in the database used to develop this essay.6 We first discuss the strengths of the original BRICS economies followed by the new members’ strengths. All the data used in the development of this essay is presented in Appendix 1.

At the core of Brazil’s competitiveness is the liveliness of its economy, its society’s open and positive attitudes, and the business-friendly environment that the country has developed. Brazil’s cost of living is an important component of its dynamism as it enables the country to attract foreign investment and contributes to an environment that is conducive to business. Cost-of-living index data shows that the country has been able to control it from 86.3 (out of 100) in 2017 to 59.74 in 2022. Brazil’s dependency ratio (the population under 15 years of age and over 64 who depend on the active population aged 15 to 64 years) shows another competitiveness strength. The ratio has been consistent since 2014 when it had a value of 44.16% dropping slightly to 43.05% in 2022. In addition, the country’s terms of trade index has been steadily positive since 2014, which signals the vibrancy of its export sector.

A fundamental factor for the competitiveness of an economy is the strength of its small and medium-sized enterprises (SMEs) sector as it provides the foundation for innovation and ultimately for productivity. In the case of Brazil, since 2014 the total early-stage entrepreneurial activity — a measurement of the strength of SMEs — has fluctuated around 20% of the population who are nascent entrepreneurs or owner-managers of new business, reaching its highest (23.4%) in 2020. The country also consistently invests in its healthcare system contributing to the quality of life of its population. Data shows that the country has increased its total health expenditure from 8.4% of its GDP in 2014 to 10.31% in 2020. Brazil also presents signs that its society is becoming more open and inclusive. The women in management indicator shows that 36.5% of senior or middle managers were female in 2014 increasing to 37.2% in 2021, although it dropped to 35.5% in 2020.

India is also characterized by a lively economy. Such dynamism is anchored in the adaptability of government policy to changes in the economy, a sign of institutional strength. Policy adaptability increased from 3.94 (out of a maximum value of 10) in 2014 to 6.24 in 2023. Additionally, as the data in Appendix 1 shows, the diversification of India’s economy is a fundamental driver of India’s competitiveness. By both measures of diversification, export concentration by partner and by product, India has maintained exports to its top five trade partners between 35% to 40% of total exports since 2014. At the same time, its percentage of information and communication technology (ICT) service exports increased from 48.87% in 2015 to 49.67% in 2021.

The strength of India’s economy is also underscored by its stock market capitalization, which rose from 78.89% of GDP in 2014 to 88.75% in 2017 and then to 96.51% in 2020. Similarly, a measure of the adequacy of the stock market’s provision of finance to enterprises shows an increase from 6.34 (out of a maximum value of 10) in 2014 to 7.01 in 2023.

The data shows India’s improvement with respect to environment-related issues in the last decade or so. Its contribution to the development of environment-related technologies worldwide increased from 1.06% to 1.33% during 2014 to 2019. At the same time, India’s share of renewable energies out of the total energy requirements increased from 22.61% in 2014 to 25.4% in 2020.

The dynamism of China’s economy and its policy stability and predictability are the foundation of its competitiveness strengths. As in the case of India, with some fluctuation, China’s adaptability of government policy has been consistently increasing between 2014 (5.72 out of 10) and 2023 (6.98), although it reached its highest (7.5) in 2021. In another driver of economic vigor, the private sector’s awareness of changing market conditions, China’s score is consistent reaching its highest 7.81 (out of 10) in 2022 but dropping slightly in 2023 (7.68). In addition, the digitalization of companies fuels the buoyancy of the economy with a measure of the implementation of the digital transformation in companies showing a value of 6.99 (out of 10) in 2018 dropping marginally to 6.87 in 2023.

The data also shows the strength of China’s SMEs sector. Its new business density (registered new businesses per 1,000 people aged 15 to 64) increased to 9.08 in 2016 dropping to 8.58 in 2020. In addition, its exports sector greatly contributes to its competitiveness strengths. For example, the value of its exports of goods increased from USD 2,342.29 billion in 2014 to USD 3,593.6 billion in 2022. Similarly, the direct investment flows inward to China increased from USD 268.1 billion in 2014 to USD 333.98 billion in 2021.

South Africa’s competitiveness strengths are underlined by its effective legal environment, open and positive attitudes, and the dynamism of its economy. The country’s performance in the freedom of the press indicator evidenced the effectiveness of its legal system. It reached a value of 79.88 (out of a maximum value of 100) in 2017 dropping to 78.6 in 2023.

In terms of its economic agility, South Africa’s SMEs sector plays a key role. Its new business density increased from 6.58 (registered new business per 1,000 people) in 2014 to 12.5 in 2020. Similarly, the total early-stage entrepreneurial activity in the country rose from 6.97% of the population involved in entrepreneurial activities in 2014 to 17.49% in 2021. Another competitiveness strength is the country’s attraction of direct investment flows (inward) which increased from 36.47% of GDP in 2014 to 41.3% in 2021. The cost of living also contributes to economic dynamism, with data from 2015 indicating that such cost was at 55.1 (out of a maximum of 100) reaching its highest value in 2018 (61.3) and then declining to 53.32 in 2022.

The government greatly contributes to the buoyancy of the economy by actively investing in key aspects, which ultimately can ensure the sustainability thereof. Data on investment in telecommunications, a core driver of the digitalization of the economy, shows that the country dedicated 0.33% of GDP in 2015 to such an investment increasing to 0.52% in 2022. In addition, total public expenditure on education increased from 6.31% of GDP in 2016 to 8.34% in 2020. Similarly, total health expenditure rose from 7.93% of GDP in 2014 to 8.58% in 2020.

Saudi Arabia anchors its competitiveness in its policy stability and predictability and in its dynamic economy. In regard to policies, the adaptability of government policy to changes in the economy, for example, increased from 5.52 (out of 10) in 2017 to 7.69 in 2023. In addition, the effectiveness of Saudi Arabia’s legal and regulatory framework in promoting competitiveness rose from 5.28 (out of 10) in 2017 to 7.49 in 2023.

The effectiveness of public-private partnerships (PPPs) in supporting technological development contributes to the country’s economic dynamism. The PPPs indicator advanced from 5.87 (out of 10) in 2017 to 7.59 in 2023. In addition, the effective management of public finances adds to the liveliness of the economy. Data shows that in 2017, the effectiveness of public finance had a value of 5.92 (out of 10) in 2017 improving to 7.98 in 2023. The availability of funding for technological development (FTD) and venture capital (VC) also sustain Saudi Arabia’s economic dynamism. In the case of FTD, it improved from 5.94 (out of 10) in 2017 to 8.08 in 2023. Likewise, VC declined from 4.63 (out of 10) in 2017 to 4.19 in 2018 but advanced to 7.03 in 2023. As in Brazil, another key component of Saudi Arabia’s dynamism is its dependency ratio. The ratio of those under 15 years of age and over 64 who depend on the active population decreased from 42.12% in 2014 to 40.36% in 2022.

The UAE’s competitiveness strengths are driven by its attractive business-friendly environment and the vigor of its economy. The adaptability of government policy to changes in the economy underlines the business environment. It scored 7.54 (out of 10) in 2014 reaching its highest value (8.17) in 2021 and then declining to 7.97 in 2023. Despite this drop, policy adaptability remains a competitiveness strength of the Emirates. Another indication of a friendly business context is the attractiveness of the country to highly skilled talent from abroad. In the relevant indicator, the UAE consistently achieves high scores despite dropping from its highest 8.42 (out of 10) in 2017 and 2021 to 7.77 in 2023.

The scientific infrastructure of an economy strengthens its dynamism. A key aspect of such infrastructure is the development of relevant talent. A measure of that development is the percentage of graduates in sciences (namely, ICT, engineering, math, and natural sciences). In that indicator, the UAE scores 21.82% in 2015 rising to 30.98% in 2019 and then to 36.19% in 2022.

Moreover, the agility of UAE’s economy is evidenced by the performance of its export sector. The exports of goods as a percentage of GDP rose from 81.34% in 2017 to 95.94% in 2020, and by 2022, it increased to 118.03%. As in the case of other economies discussed in this essay, the UAE’s dependency ratio of those who depend on the active population is a competitiveness strength that underlines its economic buoyancy. In 2015, the UAE scored 13.47% in that ratio. Since that year, it steadily increased reaching 16.54% in 2019 and then to 17.22% in 2022. Despite such an increase, the ratio remains low with less than a fifth of the population depending on the economically active and thus remains as one of the competitiveness strengths of the UAE.

As the discussion above makes clear, the expanded BRICS, as an organization, offers a set of dynamic markets with relatively stable political systems that could influence the future of the global economy. The strength of these economies lies for some in the dynamism of their SMEs sectors and for others in the agility of their political systems. As an intergovernmental organization, therefore, the members of the expanded BRICS complement one other, which in turn ensures the sustainability of their creation of wealth.

1 Although, at the time of writing there have been contradictory announcements about Saudi Arabia’s official BRICS' membership see reuters.com/world/saudi-arabia-has-not-yet-joined-brics-minister-2024-01-16/ accessed 17 January 2024.

2 Katanich, D. (2023). How the BRICS expansion could shake up the world economy. Euronews Business. Available from euronews.com/business/2023/08/29/how-the-brics-expansion-could-shake-up-the-world-economy accessed 3 January 2024.

3 Bris, A. and Caballero, J. (2015). Revisiting the Fundamentals of Competitiveness: A Proposal. In the IMD World Competitiveness Yearbook. Lausanne: IMD World Competitiveness Center.

4 All data discussed is available from the IMD World Competitiveness Center’s IMD World Competitiveness Online. Available from worldcompetitiveness.imd.org/ accessed 7 January 2024.

5 The methodology used in the gathering of statistical data and the development of survey indicators discussed in this essay is presented in the following link. imd.org/centers/wcc/world-competitiveness-center/rankings/world-competitiveness-ranking/ accessed 7 January 2024.

6 The countries not included in the database are Egypt, Ethiopia, Iran, and Russia. Russia has been excluded since 2022 due to the limited reliability of the data collected. The other countries are not part of the database due to the process employed to compile the data, particularly survey data.