Dr. Juerg Steffen, FIMC, is Chief Executive Officer at Henley & Partners.

The erosion of wealth security across developed jurisdictions has fundamentally altered the risk-return calculus for high-net-worth individuals and sovereign states alike. Today’s sophisticated ultra-wealthy investors — many holding powerful passports from economically robust, democratic nations — don’t necessarily lack mobility. They need something more nuanced: a systematic way to evaluate jurisdictional risk, measure adaptive capacity, and construct portfolios resilient to compound shocks.

The Global Investment Risk and Resilience Index address this gap, providing data-driven comparisons of 150 nations’ abilities to withstand and recover from crises. This pioneering framework enables investors to move beyond simplistic safe-haven assumptions towards evidence-based jurisdictional diversification, while offering governments actionable insights for strengthening their positioning as stable anchors for foreign investment.

Consider the expanding reach of state economic intervention. China now counts 432 ex-billionaires, with Jack Ma’s fortune halved after he criticized financial regulators. Following Russia’s invasion of Ukraine, Western nations froze USD 80 billion in privately owned Russian assets while Russia conducted its own seizures worth USD 50 billion. Wealthy individuals found themselves targeted from both directions. Jurisdictional concentration can create catastrophic risk exposure that conventional single-jurisdiction wealth preservation approaches cannot mitigate.

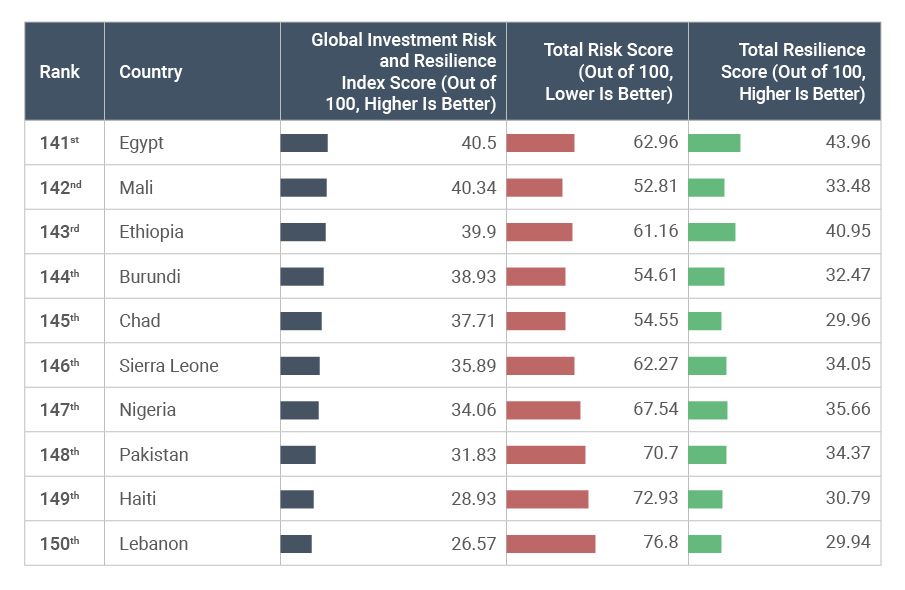

The Global Investment Risk and Resilience Index quantifies these dynamics. Lebanon, once the ‘Switzerland of the Middle East’ and a regional banking hub, now ranks last. Its precipitous decline demonstrates that even established financial centers remain vulnerable to systemic shocks when lacking diversification mechanisms. The index reveals that nations with robust residence and citizenship programs consistently outperform on resilience metrics — not coincidentally, but structurally.

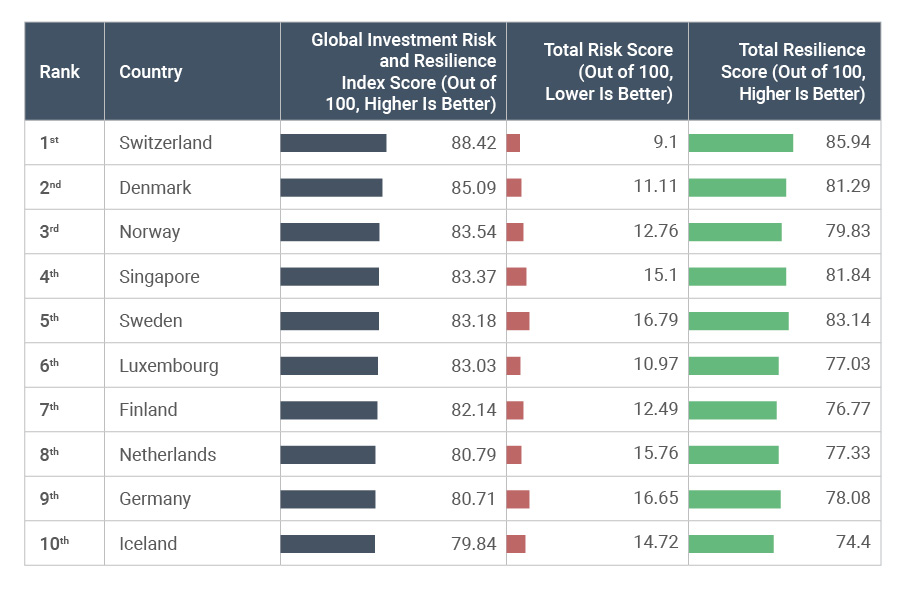

Top 10 Countries in the Global Investment Risk and Resilience Index

Bottom 10 Countries in the Global Investment Risk and Resilience Index

Residence and citizenship programs reconceptualize government financing, replacing sovereign debt with sovereign equity. Rather than borrowing against future tax revenues through bond issuances, nations attract immediate capital investments while acquiring economically productive citizens who generate sustained value creation. This shift benefits not only individual investors seeking jurisdictional diversification, but entire populations through job creation, economic development, and enhanced fiscal stability.

Singapore’s Global Investor Program exemplifies this methodology, requiring substantial capital commitments while attracting entrepreneurs whose subsequent commercial activities produce multiplier effects throughout the economy. Portugal’s Golden Residence Permit Program demonstrates comparable dynamics. The program drew considerable foreign capital just as Portugal emerged from its debt crisis, offering crucial funding when traditional borrowing sources remained constrained. Its architecture — mandating long-term investment commitments —generated stable capital reservoirs that buttressed housing markets, maintained construction jobs, and provided governments with reliable revenue flows supporting public spending and infrastructure projects.

The resilience benefits transcend immediate capital injection and extend throughout society. Investment migrants typically maintain geographically diversified portfolios, creating natural hedging mechanisms against localized economic contractions. During financial crises, foreign residents maintaining diversified international holdings can sustain business operations and employment levels while domestic capital remains constrained. This external liquidity provision during periods of financial stress constitutes automatic economic stabilization unavailable through conventional monetary or fiscal policy instruments, preserving jobs and business continuity for entire communities.

Nations achieving superior performance on the Global Investment Risk and Resilience Index — Switzerland, Singapore, Canada, and increasingly the USA — operate sophisticated residence and citizenship architectures that generate compound advantages through self-reinforcing benefits and intelligence value creation.

The scale of this phenomenon has grown substantially, with increasing numbers of high-net-worth individuals relocating for investment opportunities, favorable tax regimes, or personal and professional security. These flows create distributed intelligence networks that provide destination countries with real-time insights into emerging global risks. When applications surge from specific source countries, it often signals deteriorating conditions before broader recognition emerges — offering governments crucial lead time to adjust policies and prepare responses. This early warning capability proves invaluable during periods of geopolitical fragmentation, as investment migration patterns anticipate and parallel broader economic realignments.

Countries maintaining active investment migrant populations demonstrate stronger property rights protections and more predictable regulatory environments. The logic is straightforward: nations that arbitrarily impose capital controls or asset seizures destroy their ability to attract future investment migrants. This creates powerful incentives for policy stability and rule of law — benefiting not just wealthy migrants but entire populations through enhanced economic predictability.

Small nations demonstrate these effects most clearly. In Malta, Mauritius, and several Caribbean nations, program revenue has enabled infrastructure development, education improvements, and economic diversification that enhance resilience for all citizens.

The index data confirms that nations with well-structured residence and citizenship programs consistently demonstrate superior adaptive capacity. These programs attract patient capital that remains committed during volatility, expertise that accelerates economic transformation, and networks that facilitate market access during disruptions. For destination countries, this translates into measurable improvements across resilience indicators: stronger fiscal positions, more complex economies, and enhanced innovation capacity.

Residence and citizenship programs represent more than discrete policy instruments — they constitute comprehensive approaches to constructing resilient national economies capable of deriving strength from global volatility.

For individuals across the wealth levels, they provide essential jurisdictional diversification against the expanding reach of state power and systemic risks.

For nations, they create stakeholder alignment mechanisms that enhance long-term stability while attracting the capital, expertise, and networks necessary for sustained competitive advantage that benefits entire societies.

The Global Investment Risk and Resilience Index makes these dynamics measurable, enabling both investors and governments to move beyond intuition towards evidence-based resilience building.