Ugur Altundal is a researcher in political science at Syracuse University.

Omer Zarpli is a researcher in political science at the University of Pittsburgh.

Although halfway through 2021 most countries maintain relatively open borders, except to visitors from high-risk countries, the situation remains extremely volatile. In tandem with the easing of border restrictions by some countries, the number of international travelers is increasing, albeit painfully slowly. The regions that have been able to receive travelers from the USA are showing the most positive signs in terms of tourism recovery, but global mobility remains largely inhibited.

After the initial shutdown that effectively grounded international travel, the past 12 months have seen many governments gradually relaxing border restrictions while maintaining bans on visitors from countries experiencing surges in cases or where virulent new Covid variants have been detected. In early July, a handful of countries (including Australia, Argentina, Canada, New Zealand, and Japan) maintain total border closure to most international visitors.

The availability of vaccines has somewhat accelerated normalization efforts, notwithstanding significant gaps in vaccination rates between developed and economically developing nations. Many countries require travelers to provide proof of vaccination or a negative PCR test, making travel virtually impossible for most inhabitants of the global South.

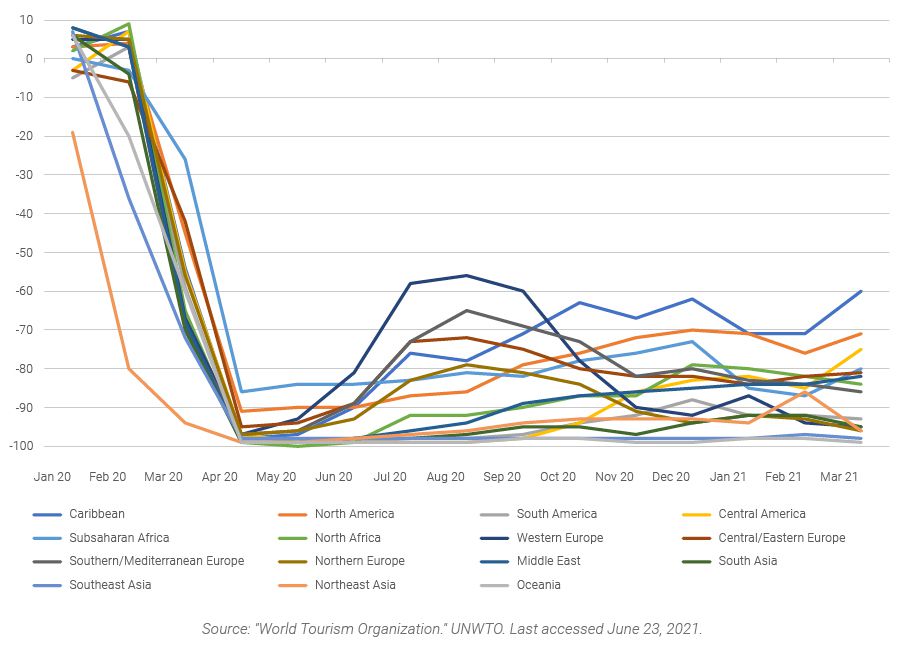

The steady increase in airline seat capacity in 2021 is evidence that global mobility is slowly gaining momentum, but cross-border movements remain well below pre-pandemic levels. According to the United Nations World Tourism Organization, there was a 97% drop in international travel in April 2020 compared to April 2019, pre-Covid. Between January and March 2021, this had improved marginally to 88%, with business and essential travel the primary drivers of the recovery of just 12% of previous global mobility. There are, however, notable regional variations as illustrated in Figure 1.

Figure 1 International tourist arrivals by region, January 2020 to March 2021

While the Caribbean has come closest to pre-pandemic tourism levels, inbound tourism remains far below January 2020 levels. In March 2021, it received 40% of international visitors it did in March 2019, with Puerto Rico, US Virgin Islands, and Dominican Republic leading the recovery. The Caribbean is followed by North America (namely, Canada, Mexico, and the USA), which received 29% of its pre-pandemic visitors in March. Among the three countries, Mexico has come closest to reaching pre-pandemic inbound tourism levels. Central America follows North America, having seen a quarter of the visitors in March 2021 as it did in March 2019 before the pandemic started. The revival of tourism in the Americas is mainly driven by visitors from the USA.

In Europe, the recovery has been slower, as many countries continue to maintain restrictions. In Western Europe, for example, international travelers to Austria, the Netherlands, and Germany had declined by 98%, 93%, and 92%, respectively, between January and March 2021 compared to the same period last year. In the UK, the number of international visitors in 2020 was 73% lower than in 2019. According to The Office of National Statistics, 72% of inbound travel to the UK was from Europe, with 11% from North America and 17% from the rest of the world. In Southern Europe, between January and March 2021 Turkey had received almost half the number of tourists as it did between January and March 2020.

Countries in Southeast Asia and Oceania have been far slower in opening up for tourism and, as can be seen in Figure 1, have very different trajectories as a result. In March 2021, Southeast Asia and Oceania received only 2% and 1% of the visitors they did in March 2019.

The return of international travel will no doubt help to revive economies that depend heavily on travel and tourism as a source of GDP along with prudent monetary and fiscal policies. For many island nations, tourism is the lifeblood, with the British Virgin Islands, Aruba, and the Maldives being the most tourism-dependent. Among the larger economies, Thailand, the Philippines, Mexico, and Spain are most reliant on international visitors.

Among the major determinants of freeing up mobility and rebooting the global economy are vaccine access and the pace of vaccination programs in second half of 2021.

References

Callaway, E. “Delta Coronavirus Variant: Scientists Brace for Impact.” Nature, June 22, 2021.

Hale, T, Angrist, N, Goldszmidt, R, Kira, B, Petherick, A, Phillips, T, Webster, S, et al. “A Global Panel Database of Pandemic Policies (Oxford COVID-19 Government Response Tracker).” Nature News. Nature Publishing Group, March 8, 2021.

OAG Aviation. “COVID-19 and Airline Schedules.” OAG. Accessed June 10, 2021.

Osborn, A. “Overseas Travel and Tourism: 2020.” Overseas travel and tourism - Office for National Statistics. Office for National Statistics, May 23, 2021.

Quinn, C. “The Tourism Industry Is in Trouble. These Countries Will Suffer the Most.” Foreign Policy. Foreign Policy, April 23, 2020.

Whitley, A; Philip, S. V; Odeh, L. “Where Can You Fly Right Now? Americans Jet South to Caribbean Beaches.” Bloomberg, May 6, 2021.

“World Tourism Organization.” UNWTO. Accessed June 10, 2021.

York, G; Waldie, P; Morrow, A; Agius, J. “The Global COVID-19 Vaccine Gap: Eight Charts on the Race to Inoculate the World.” The Globe and Mail, June 24, 2021.