Miguel López de Silanes is International Market Leader at Family Office Exchange.

Peter Moustakerski is Chief Executive Officer at Family Office Exchange.

In the context of rising investor mobility, evolving family office models, and intensifying global pressures, adaptability has emerged as a defining factor for lasting generational success. For business and enterprise families1 in the USA — many of whom are navigating unprecedented shifts in taxation, regulation, demographics, and mobility — the capacity to respond strategically to change is not merely advantageous, but essential. Much like Odysseus on his epic journey in Homer’s The Odyssey, modern business and enterprise families must navigate complex risks and seize emerging opportunities if they are to preserve their legacy and remain relevant. The journey ahead calls not only for resilience, but for bold, forward-thinking reinvention across governance, investment, leadership, and global mobility.

The concept of adaptability is not new, but its critical importance has been magnified in recent years by rising macro-economic instability, shifting global tax regimes, and a redefinition of wealth itself.

The BCG Henderson Institute called it “vitality”. Prof. Willie Pietersen from Columbia Business School identified “five killer competencies” required to become an adaptive enterprise. Dr. Dennis T. Jaffe identified adaptability — made up in turn of several sub-components — as the key behind the success of 100-year-old families, which he referred to as “generative families” or “enterprising families”. Former CEO of Intel, Andrew S. Grove and former options trader Nassim Nicholas Taleb have both linked adaptability, and openness to change, to paranoia.2 While Grove argues that constant vigilance towards threats is essential for adaptability, Taleb recognizes that precautionary behavior can be mistaken for paranoia but can be a rational strategy.

In all the above cases, adaptability is identified as being key to long-term success. In the current climate, business and enterprise families must consider new risk variables while maintaining clarity of vision and operational flexibility. Increasingly, sustained success hinges on a family’s ability to adjust proactively to emerging threats and disruptions.

Many business and enterprise families already perform significant work around risk management. This entails systematically identifying internal and external threats, prioritizing them based on their potential impact, and developing mitigation strategies. These may include managing and resolving perceived risks such as the lack of a common vision, leadership gaps, or succession uncertainties, or they may require hedging such as diversifying jurisdictions for business operations, investments, or residences.

In addition, many of these families are strengthening or adapting their systems and structures including their values, vision, governance systems, leadership development, and strategic, and succession plans. In essence, making the ship stronger for sailing rougher waters ahead.

However, less attention is paid to the flipside of risk management: opportunity management. This requires developing new capabilities and alternative forms of capital and possibly reinventing the whole business or enterprise family. Opportunity management also entails taking some calculated risks, but acknowledging that inertia and complacency are the highest risks and there is always a correlation between risk and return/reward in the long run.

Risk and opportunity management are also intertwined with complexity. Increased internal complexity is the natural result of the growth of the family and their investments and activities as well as of the riskier and more uncertain context, which requires additional structures, redundancy plans, and more complex governance and control systems.

Managing this complexity is important and requires discernment: building new layers where they add strategic value, such as education for the next generation, regular family meetings, and shared traditions, while simplifying or outsourcing activities that do not help the family achieve long-term success.

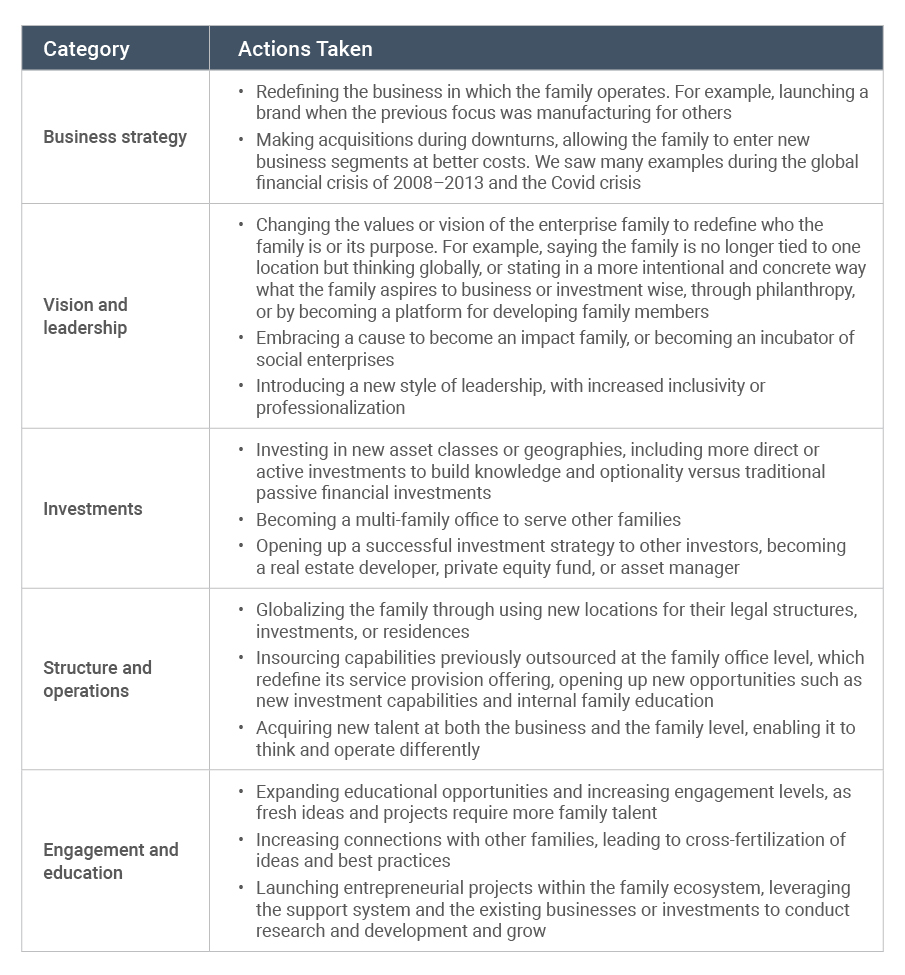

Some examples of adaptability actions being performed by global business and enterprise families include the following:

Today´s business and enterprise families need to develop the muscle of adaptability, turning risks into opportunities and improving their prowess at every turn. Ultimately, the goal is to embed adaptability into the family culture and gain a durable competitive advantage, equipping them to navigate future shocks and achieve their evolving goals to remain relevant.

As Charles Darwin once observed, “It is not the strongest of the species that survives, nor the most intelligent, but the one most adaptable to change.” For families stewarding generational wealth in a rapidly changing world, the same principle holds true.

Notes

1 Enterprise families are those that are no longer business centric, and thus are multi-generational, thinking in family unity for decades to come. These families are intentional about developing other forms of capital in addition to the business, such as financial capital, family social capital, philanthropic capital, intellectual and human capital, and others.

2 Andrew S. Grove published Only the Paranoid Survive and Nassim Nicholas Taleb wrote The Black Swan: The Impact of the Highly Improbable.