Kelcie Sellers is Associate Director at Savills World Research.

Prime residential property has remained incredibly resilient in the face of ongoing headwinds. Capital values for prime properties in World Cities rose by 1.3% in the six months leading up to December 2024, culminating in an annual growth of 2.2%. This continuing confidence in global residential sales has also permeated the Monaco market, where average prices per m2 increased by 1% in 2024.

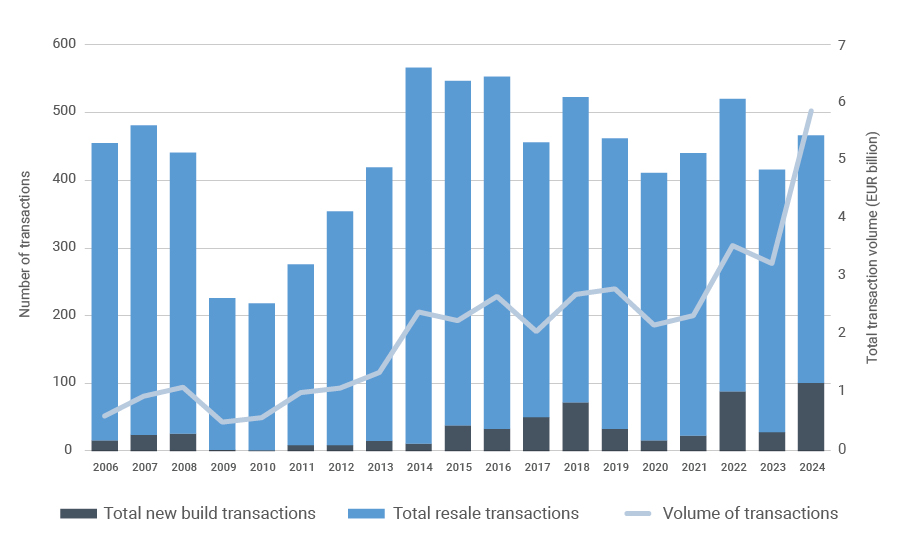

Monaco’s property market has long been characterized by chronic under-supply, a situation exacerbated by the micro-state’s diminutive size — less than half the size of New York’s Central Park. However, the official launch of the Mareterra land reclamation and development project has added 110 apartments and 10 villas to Monaco’s housing supply, leading to record transaction volumes. In 2024, total new-build sales volumes soared to nearly EUR 3.7 billion, while total sales volumes for all properties reached EUR 5.8 billion.

The total count of transactions in Monaco rebounded by 21% from 2023 levels to 466 sales, largely driven by new transactions at Mareterra. With 101 new-build sales in 2024, this represents a staggering 260% increase from 2023. Historically, new-build sales accounted for less than 10% of total sales in Monaco; however, the launch of Mareterra increased the share to 21% last year. This surge in transactions mirrors the trends in Monaco’s most recent census data, which shows a 2.8% increase in residents since 2016.

Number and Volume of Transactions, 2024

Source: Savills research using IMSEE

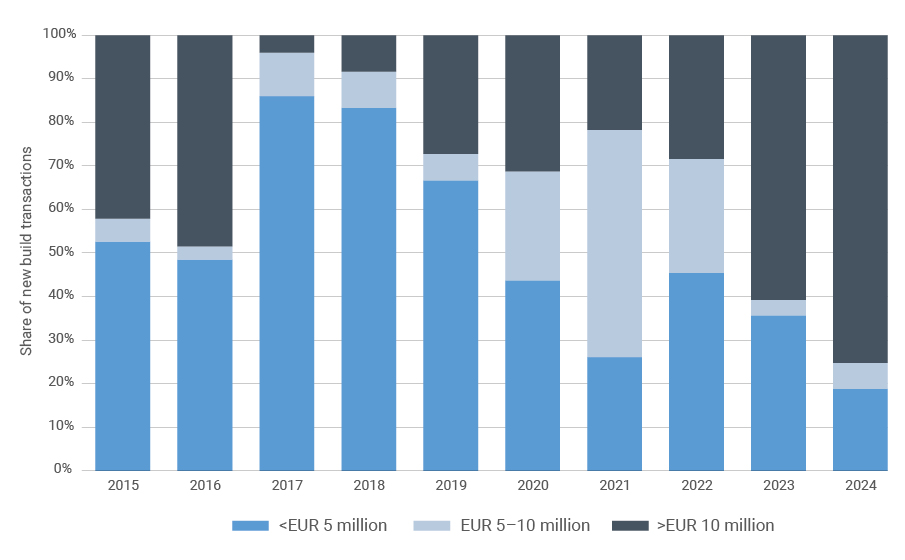

The price ranges of new sales have seen a dramatic shift over the past two years. In 2022, sales of new properties valued at over EUR 10 million made up just 28% of the new development market. In 2023, that figure grew to 61%, rising to 75% by the end of 2024. This trend underscores the continued interest in ultra-prime new developments such as Mareterra, and the impact of residency rule changes, which have increased the appeal of larger apartments in the Principality.

While sales of studios and one-bedroom flats still account for nearly 50% of total sales in Monaco, this share has been declining slowly since 2020. Sales of two- and three-bedroom flats accounted for 36% of total sales in 2024, reflecting the growing popularity of larger home sizes in line with stricter residency requirements. The share of three-bedroom flats has been increasing year-on-year and stood at nearly 15% of total sales last year.

New-Build Sales in Monaco by Price Point

Source: Savills Research using IMSEE

Purchasing property in Monaco isn’t just about being in the microstate itself — each district within the Principality has its own distinct personality. Jardin Exotique and Larvotto stand out as regions with impressive annual price growth, with 20% and 48%, respectively, in 2024. Monte-Carlo, which accounted for 21.6% of residents and 22% of the housing stock last year remained the most popular market for resale transactions, with one-third of resales in the principality and 11% year-on-year growth.

Larvotto, which is home to Mareterra, is among the least densely developed residential markets in Monaco, with only 1,263 residences. This number does not include Mareterra, as the census only includes properties built by 31 December 2023. However, changes in price in this sub-market will be magnified by the new development.

Monaco remains the most expensive location worldwide for renting residential property, far surpassing the average asking rents of New York (Monaco is 12% higher), London (146%), Hong Kong (52%), and Geneva (232%). For many prospective residents, renting a property and experiencing the lifestyle is often the first step before purchasing an apartment.

Within the Savills World Cities Prime Residential Index, prime rents increased by 4.4% in the year to December 2024. Monaco once again outpaced the global trend, with rents rising by 6% in 2024 to EUR 114.50 per m2 per month. Three-bedroom flats saw the strongest increases in rental prices, growing by 56% to EUR 142.30 per m2 per month, echoing the trend in the purchase market, where size matters.

Confidence is a key driver for prime residential markets worldwide, and Monaco’s perceived safe-haven status will continue to attract buyers and renters. This ongoing demand will likely support pricing, but transactions are expected to remain steady due to the limited supply of property.

Only a few projects are currently in the pipeline: Mareterra is completed, and other new developments like Bay House and L’Exotique have brought just 69 apartments and five villas to the Principality’s residential supply. Land constraints mean other significant new builds are unlikely in the near future. As such, Monaco’s property market should see sustained capital growth moving forward.