Dmitry Kaminskiy is a co-founder and managing partner of Deep Knowledge Group.

The global megatrend of longevity industrialization has progressed substantially over the past five years, with the notion of extending healthy human longevity moving from the realm of fringe science to become a major strategic priority for large and reputable investors, financial corporations, and even governments.

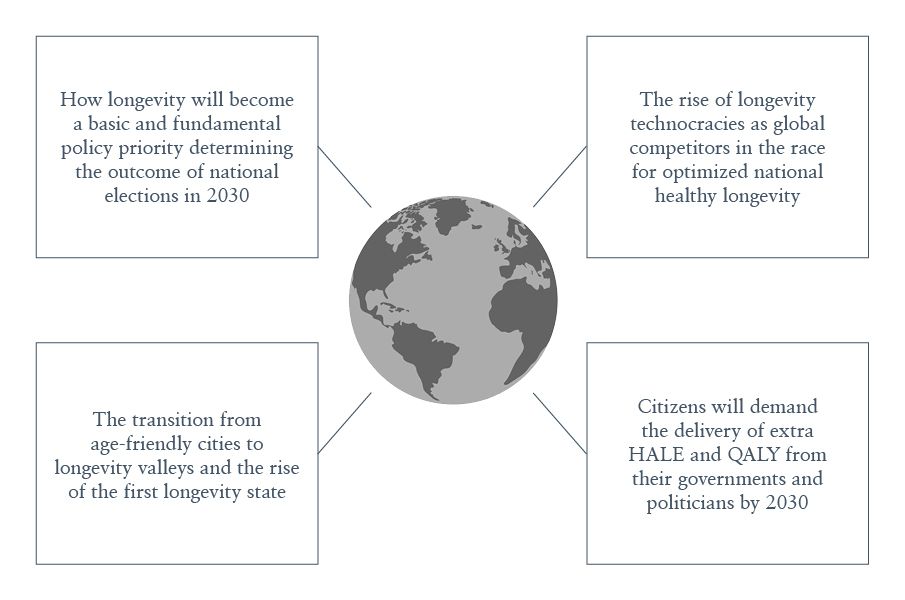

In 2021, the upward trajectory of longevity industrialization has reached a point where politicians and governments are major actors and drivers of growth. In other words, we have entered an age of longevity politics.

As developments in the longevity arena progress, we can expect that the maintenance, optimization, and extension of citizens’ healthy lifespans will come to be seen as their fundamental right and an essential duty of governments that will be demanded by the electorates of most developed nations by the year 2030.

In the last few years, new terms have entered our political vocabularies, which are used to describe how we measure healthspan — the number of years a person can live free from age-related disease, illness, and dysfunction. Perhaps the most important of these metrics are health-adjusted life expectancy (HALE) and quality-adjusted life expectancy (QALY).

The nations that achieve national HALE and QALY will come to be seen as the first true longevity states, and the regions and municipalities within them — the industry clusters that will be the engines of change — will come to be recognized as the first longevity valleys.

Already we are seeing that the prospect of technologically extended HALE and QALY is impacting investor expectations, and lifestyle priorities are driving the choices of ultra-high-net- worth individuals (UHNWIs). In 2018, UBS Investor Watch reported that more than 50% of wealthy investors expected to live for 100 years and that nine in ten investors were taking steps in response to increasing life expectancy — adjusting their spending habits and financial plans, and allocating their wealth to long-term investments. UBS concluded that living a 100-year life is not an outcome the world’s wealthy consider a mere possibility, but one they expect. We are beginning to see a rapidly increasing number of UHNWIs embrace the notion of ‘health as the new wealth’, and the concept of health and healthspan as a new asset class.

In financial circles, talk of solutions to demographic aging is now as common as talk of the challenges it poses, and healthspan extension has become a logical topic of discussion for healthcare thought leaders, business analysts, investors and other industry professionals who foresee a future in which healthy longevity is an asset. Municipal and national governments have begun to shift their priorities towards this trend, outlining plans for supporting longevity industrialization within their borders. Some have gone so far as to publicly commit to the maintenance and optimization of their citizens’ healthy longevity.

The main contenders for longevity states of the future are those that currently possess robust political strategies on how to grow their national longevity industries and optimize the healthspans of their populations but lack the infrastructure or necessary frameworks to executive them, or vice versa. For example, a state may possess excellent raw resources and have a track record of successful strategy execution but lack strong, clear governmental commitment and an industrial strategy for marshaling its resources — a form of industrial strategy that amounts to what we might refer to as a ‘longevity development plan’. The top contenders for establishing the first longevity state by 2030 are discussed below.

The UK government is a leading example of a government with both the necessary will and a robust strategy. In 2017, it named the ageing society as one of its four Industrial Strategy Grand Challenges, alongside artificial intelligence (AI) and data, clean growth, and future of mobility. The UK government established the UK Research and Innovation Healthy Ageing Industrial Strategy Challenge Fund in 2018 and the world’s first All-Party Parliamentary Group for Longevity in 2019 and, later that year, announced its commitment to add five extra years HALE to all citizens of all social classes by 2035.

The US stands out as a nation that could quickly establish itself as an international leader in longevity governance but has not yet done so. It has extremely uncompetitive levels of healthcare efficiency and a very high oncoming economic burden caused by population aging. The US also lacks any formal recognition of or public commitment towards longevity industrialization. It is characterized not by a weakly formulated longevity strategy, but by an absence of one.

Nonetheless, the country has some of the best resources available for strategy execution and policy leadership, including a substantial healthcare budget, a competitive economy, governmental prioritization of AI industrialization (the number-one catalyst for longevity industrialization), and by far the largest proportion of companies and investors within the global longevity industry.

Singapore is a highly efficient, technocratic city-state that has the second-highest level of HALE in the world. It is also an international leader in AgeTech. (For a detailed analysis of longevity industrialization in Singapore, see Aging Analytics Agency’s 2019 Longevity Industry in Singapore Landscape Overview.)

The levels of healthcare efficiency in Singapore and its highly competitive population health (which relates to its above-average levels of HALE and below-average prevalence of noncommunicable diseases) combined with its comparatively small size, high rates of technology penetration across both the general populace and government, and strong technocratic approach — makes it likely to be highly efficient in executing longevity government strategy and distributing social and socio-economic benefits. However, Singapore currently lacks explicit government commitment to realizing this opportunity.

Japan’s level of HALE is the world’s highest (Japan having surpassed Singapore, the previous global leader in HALE, since Aging Analytics Agency’s Global Longevity Governance Landscape Overview 2019, a big data analysis of longevity progressiveness in 50 countries).

Additionally, while Japan has one of the highest rates of population aging, its national government remains keenly aware of the socio-economic challenges aging poses, and there is a high degree of recognition that government resources must be marshaled to overcome the hurdles.

Generally speaking, Japan also has a high degree of technology penetration, a strong tech sector, and many of the raw resources required for onboarding a highly technocratic approach to governance. The country’s main downfall is its lack of a robust industrial strategy for optimizing the HALE and QALY of its populace.

The top contenders for becoming the first longevity state are all strong in either strategy formulation or execution (some more than others), but neither is strong in both. The integrated and synergetic optimization of the twin pillars of strategy and execution is the key, decisive factor in a country or territory’s ability to deliver the socio-economic benefits of longevity industrialization efficiently and sustainably, with HALE and QALY as its most precious product and commodity.

As explained in greater detail in “Longevity Politics: Longevity Technocracy, Modern Approaches to Policy, Governance & National Industrial Strategies, & Longevity as the New Political Priority of the 21st Century” (forthcoming), the countries that do so first will demonstrate a new norm of healthy longevity as a fundamental citizen right. Citizens around the world (including but not limited to high-net-worth individuals) will be drawn to the countries that can optimize and maintain the new asset class of healthy longevity — driving corresponding benefits to the growth and stability of national economies.

References

“Global Longevity Governance Landscape Overview 2019.” Aging Analytics Agency. Aging Analytics Agency, 2019.

Investor Watch. “The Century Club.” www.ubs.com/wm. UBS, December 23, 2018.

Kaminskiy, Dmitry. “Health as the New Wealth: How the Asset Class of Longevity Will Become the New Norm for Citizen and Corporate Migration.” Henley & Partners. Henley & Partners, March 23, 2021.

“Longevity Industry in Singapore.” Aging Analytics. Aging Analytics, 2019.

“Longevity Politics.” Longevity Book. Accessed June 22, 2021.