Dominic Volek, CA(SA), FIMC, is Group Head of Private Clients at Henley & Partners and a member of the Executive Committee.

The ultra-wealthy no longer seek just returns — they seek resilience through geographic arbitrage. Today’s sophisticated investors from highly developed nations already hold powerful passports; what they need is a systematic framework to evaluate jurisdictional risk and construct portfolios that thrive amid compound shocks.

The Global Investment Risk and Resilience Index provides this critical intelligence, enabling high-net-worth families to move beyond simplistic safe-haven assumptions towards data-driven geographic diversification. This is about optionality, building what we call a “sovereign portfolio” with strategic positions across multiple resilient jurisdictions.

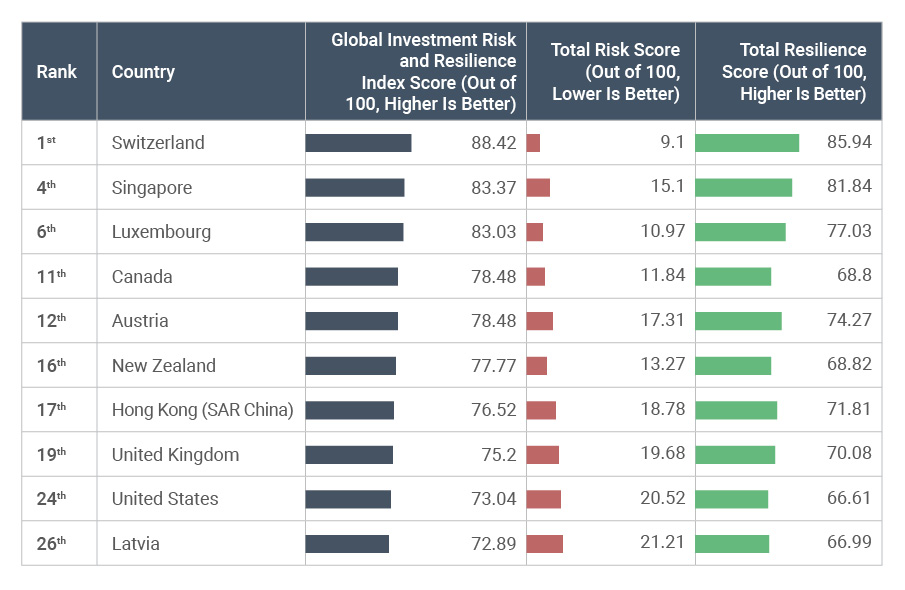

The index reveals fortress economies combining very low risk with very high resilience scores that anchor generational wealth preservation. These destinations — including Switzerland, Singapore, Luxembourg, New Zealand, Austria, and Hong Kong (SAR China) — weather downturns while staying protected from risks that sink other economies. The data shows why these nations consistently attract the world’s most astute investors, and why access to their residence and citizenship programs, or even better to build a portfolio of such programs, has become the ultimate hedge.

Top 10 Countries/Territories with Residence and Citizenship Programs in the Global Investment Risk and Resilience Index

Singapore’s Global Investor Program (GIP) as a direct path to permanent residence builds on principles former Prime Minister Lee Kuan Yew integrated into national policy: “A nation is great not by its size alone. It is the will, the cohesion, the stamina, the discipline of its people and the quality of their leaders.” These characteristics underpin Singapore’s 4th place on the global index with a score of 83.37 out of 100 — Asia’s strongest performer among major economies.

Within 278 square miles, Singapore houses 333 centi-millionaires — exceeding one per square mile. This wealth distribution reaches beyond the ultra-wealthy, with the city-state leading globally in GDP per capita for its 6 million residents when adjusted for purchasing power parity. The Singapore GIP sets formidable thresholds — an investment of SGD 10 million (including paid-up capital) into a new or existing business in Singapore or invest SGD 25 million into a fund approved by the Singapore Economic Development Board (EDB). Alternatively, you can establish a Singapore-based single family office with assets under management of at least SGD 200 million.

Hong Kong (17th globally with a score of 76.52) preserves its status as a key market while managing regional complexities. The Capital Investment Entrant Scheme, with a minimum HKD 30 million investment, provides entry to an economy with minimal regulatory constraints, zero capital gains taxation, and advanced financial systems. Hong Kong's resilience reflects its ability to manage political shifts while sustaining economic vitality.

New Zealand’s Active Investor Plus visa (NZD 5‒10 million investment) presents alternative Pacific opportunities at 16th place globally with an overall score of 77.77. Where Singapore and Hong Kong deliver concentration and connectivity, New Zealand provides separation and protection — geographic diversification for families requiring distance from international instability while retaining robust legal frameworks, English-language education, and Asia-Pacific market connections.

Switzerland’s cantonal structure generates competitive benefits measured in centuries rather than decades. Ranked 1st worldwide on the Global Investment Risk and Resilience Index with a score of 88.42, Switzerland gives wealthy families an increasingly scarce resource: institutional reliability and confidentiality developed through extended political neutrality and budgetary restraint.

With almost 500 foreign residents employing lump-sum tax arrangements across cantons featuring corporate rates reaching 11.8%, the Swiss model acknowledges that ultra-wealthy families plan across generations. Political continuity and premier private banking services establish conditions where wealth accumulates through multiple generations without political disruption or policy swings.

Austria (12th globally, scoring 78.48) grants citizenship for exceptional contributions, delivering EU membership with Germanic precision. Vienna’s regular recognition as the world’s most habitable city plus beneficial tax agreements provides optimal conditions for family offices coordinating European activities. The program’s adaptability — permitting contributions to arts, science, or commerce — draws culturally engaged investors pursuing substantial integration beyond simple residence.

Luxembourg (6th globally, with a score of 83.03) remains Europe’s wealthiest per-capita nation, its EUR 500,000 residence by investment framework providing refined tax arrangements via a leading financial hub. Although the program confronts possible closure, present access holds particular value for those requiring EU placement with reduced risk factors.

Canada (11th globally, scoring 78.48) demonstrates methodical strength via its Start-Up Visa Program (investment requirements including all fees:

USD 215,000‒275,000, depending on the start-up business). The framework mandates investment in enterprises validated by specified entities — venture capital groups, angel investors, or business accelerators — guaranteeing participants contribute operational expertise together with funding. Following three years of permanent residence, candidates may seek Canadian citizenship, obtaining a passport enabling visa-free access to 180+ destinations.

The USA (24th placed with a score of 73.04), though experiencing domestic divisions, sustains unmatched economic energy. The US EB-5 Immigrant Investor Programs 34-year track record confirms America’s persistent appeal, with 12,055 visas granted in fiscal 2024 and USD 3 billion added to the economy. America’s draw exceeds immediate gains — it grants entry to an entrepreneurial environment that has generated greater wealth than any comparable system.

Four other countries deserve consideration as very low risk, high resilience countries: Latvia, UAE, Malta, and Uruguay. Latvia’s Residence by Investment Program (from just EUR 60,000) grants EU entry via a rapidly developing Baltic economy. The UAE’s Golden Visa (AED 2 million) offers 10-year renewable residence with zero income taxation in the Middle East’s most vibrant and diverse economy. Malta’s Permanent Residence Programme (minimum contribution of EUR 169,000 mixed capital requirements) grants residence rights to foreign nationals seeking an alternative residence in Europe, while Uruguay’s direct residence process draws those pursuing South American steadiness with beneficial tax agreements.

International families protecting multi-generational assets confront substantial obstacles. Armed conflicts persist throughout the Middle East and Europe’s eastern borders, as climate hazards accelerate globally. International economic expansion faces deceleration, with projections reduced for approximately 70% of economies. Under these conditions, institutional durability determines whether wealth endures or disappears.

The concept of a sovereign portfolio — strategic positioning across APAC, the Americas, Europe, MENA, and LATAM — transforms geographic diversification from insurance into active wealth management. Each jurisdiction offers distinct advantages: Singapore for Asian connectivity, Switzerland for institutional stability, Canada for North American innovation, UAE for Middle Eastern growth, Uruguay for South American optionality. Together, they create a resilient architecture where no single shock can destroy accumulated wealth.

For families planning past immediate yields towards enduring success, these locations provide structural benefits converting international instability from risk into possibility through geopolitical arbitrage. Their residence and citizenship program frameworks grant entry to institutional systems supporting wealth development and protection during periods when others encounter fundamental pressure. Geographic distribution through these stable territories has shifted from optional to essential when concentrated assets confront existential threats.